JPMorgan Chase, BlackRock drop out of massive UN climate alliance in stunning move/ Fox news

Was it the negative return or the potential lawsuits that is starting to turn this crazy climate leviathan around?

JPMorgan Chase and institutional investors BlackRock and State Street Global Advisors (SSGA) on Thursday announced that they are quitting or, in the case of BlackRock, substantially scaling back involvement in a massive United Nations climate alliance formed to combat global warming through corporate sustainability agreements.

In a statement, the New York-based JPMorgan Chase explained that it would exit the so-called Climate Action 100+ investor group because of the expansion of its in-house sustainability team and the establishment of its climate risk framework in recent years. BlackRock and State Street, which both manage trillions of dollars in assets, said the alliance's climate initiatives had gone too far, expressing concern about potential legal issues as well.

The stunning announcements come as the largest financial institutions in the U.S. and worldwide face an onslaught of pressure from consumer advocates and Republican states over their environmental, social and governance (ESG) priorities.

"The firm has built a team of 40 dedicated sustainable investing professionals, including investment stewardship specialists who also leverage one of the largest buy side research teams in the industry," the bank said in a statement shared with FOX Business. "Given these strengths and the evolution of its own stewardship capabilities, JPMAM (JP Morgan Asset Management) has determined that it will no longer participate in Climate Action 100+ engagements."

MEET THE LITTLE-KNOWN GROUP FUNDED BY LEFT-WING DARK MONEY THAT IS SHAPING FEDERAL CLIMATE POLICY

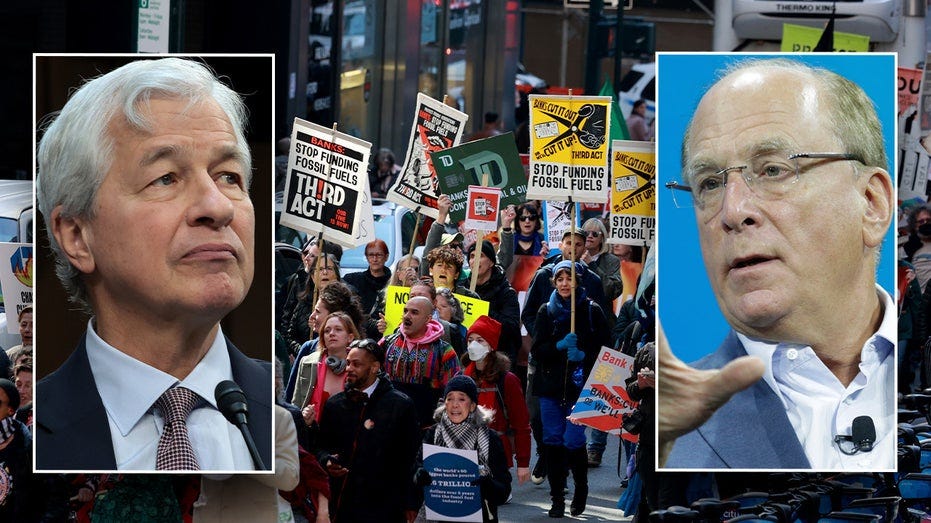

JPMorgan Chase CEO Jamie Dimon, left, and BlackRock CEO Larry Fink. (Getty Images / Getty Images)

BlackRock, meanwhile, withdrew its U.S. business from Climate Action 100+, shifting involvement in the alliance to BlackRock's smaller international entity where a majority of clients are pursuing decarbonization goals, the Financial Times first reported Thursday. A spokesperson for BlackRock confirmed to FOX Business that the move had been made in recent weeks.

And State Street said its exit from the alliance was made because Climate Action 100+'s "phase 2" commitments conflicted with the firm's internal investing policies.

Jamie Dimon, CEO of JPMorgan Chase, testifies during a Senate Banking, Housing, and Urban Affairs Committee hearing in Washington, D.C., on Dec. 6, 2023. (Tom Williams/CQ-Roll Call, Inc via Getty Images / Getty Images)

"SSGA has concluded the enhanced Climate Action 100+ phase 2 requirements for signatories are not consistent with our independent approach to proxy voting and portfolio company engagement," State Street said in a statement, according to the Financial Times.

Climate Action 100+ was formally established in December 2017 at the U.N. as a way of aligning the world's largest private sector financiers of greenhouse gas producers. Since the association was created, it has grown to include more than 700 financial institutions that are collectively responsible for a staggering $68 trillion in assets under management.

They know it's a fraud. And they know we know it's a fraud.

I don’t trust anything these people do.